Announcing the 2023 sunset of Catalyst QuickBooks.

Thank you for allowing us to serve you since 2008.

{ Comments on this entry are closed }

THE DEMANDS OF CUSTOMERS WILL COMPETE FOR ANY HOLIDAY SPARE TIME THAT YOU HAVE AVAILABLESHOULD DEMAND YOUR IMMEDIATE

CATALYST ENTERPRISE SOLUTIONS CAN HELP YOUR SMALL BUSINESS STAY LEGAL AND ACCOUNTABLE

CATALYST ENTERPRISE SOLUTIONS CAN HELP YOUR SMALL BUSINESS STAY LEGAL AND ACCOUNTABLE

GROWING TOO FAST IS DANGEROUS TO YOUR COMPANY’S HEALTH. USE SUSTAINABLE GROWTH RATIO.

CLOUD-HOSTED QUICKBOOKS IS A MAJOR STEP TOWARD A 21ST CENTURY 'PAPERLESS OFFICE'

AN AREA OF CONFUSION IS "FOREIGN QUALIFICATION" - DOING BUSINESS IN MULTIPLE STATES.

BUSINESS DATA IS STOLEN? HERE ARE RECOMMENDATIONS FROM FTC FOR HOW YOU SHOULD RESPOND.

TRADE EXCHANGES OPERATE LIKE BANKS AND ISSUE A COMMON CURRENCY CALLED 'TRADE DOLLARS.'

{ Comments on this entry are closed }

A very big congratulations to our client Lead Research Group!

Lead Research Group Tops the Annual Inc. 500 List of Fastest Growing Private Companies, AGAIN!

HUNTINGTON BEACH, Calif.–(BUSINESS WIRE)–Inc. Magazine has named Lead Research Group (LRG), a marketing and advertising agency located in Orange County, Ca., 23rd on its annual list of the fastest growing privately-held companies in the U.S. The 2010 Inc. 500 list features the most comprehensive look at the most significant segment of the economy – America’s entrepreneurial sector.

LRG’s turnkey approach, for customized lead generation and marketing solutions, was also recognized by its number three position on the Inc. 500 list for Advertising and Marketing companies.

“We are thrilled to be recognized by Inc. once again, as it highlights our innovative business marketing model that focuses solely on successful ROI,” said CEO Ryan Rasmussen. “LRG’s business advertising model is the catalyst of our impressive sales growth and confirms our unique presence in the marketing marketplace.”

Matthew Marsh, President of Lead Research Group, adds, “We are beyond proud of the LRG team for the continued growth we’ve achieved, and the team’s hard work, ambiti and dedication to our clients continues to demonstrate that even in a tight economy, LRG performance-based marketing strategies increase sales growth.”

“This is a fabulous re-validation of a corporate team whose years of vision and drive have paid off, not just for them but for thousands of business clients representing a diverse range of highly competitive industries,” said Lynnea Bylund, president of Catalyst House, LRG’s accounting and financial solutions provider.

About the Inc. 500

The 2010 Inc. 500 list, unveiled in the September issue of Inc. magazine, features the most dynamic, successful companies in the nation, the ones responsible for creating cutting-edge systems, product innovation, and fueling job growth. This year’s list reported aggregate 2009 revenue of $11.2 billion – a global reach of 45% – and employ 45,324 people, making the Inc. 500 possibly the best example of the impact these private, fast-growing companies have on the overall U.S. economy.

About Lead Research Group

LRG is a leading provider of true, performance-based marketing and advertising with the widest variety of marketing verticals, methods and niches. The LRG team, known industry-wide as the ‘Marketing Gorillas,’ provides advanced strategies to a wide variety of advertising initiatives. Lead Research Group focuses entirely on high ROI, quality performance and top-flight results. For more information about Lead Research Group, visit: www.leadresearchgroup.com.

About Catalyst QuickBooks Solutions

Worked with start up Lead Research Group | (“LRG”) 100% remotely

Inc 5000 | Inc 500

Prepared LRG Financials Inc #276 Status 2009

Prepared LRG Financials Inc #23 Status 2010

Prepared LRG Financials Inc #78 Status 2011

{ Comments on this entry are closed }

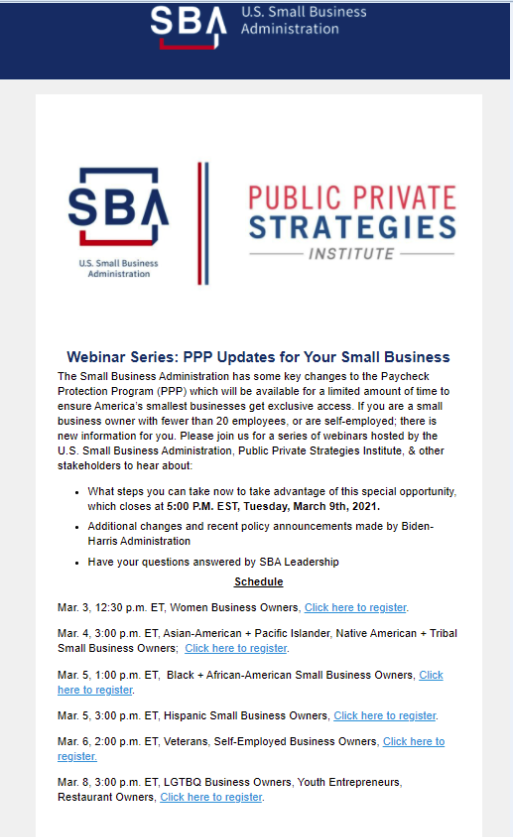

SBA Webinar Series

Schedule

Mar. 3, 12:30 p.m. ET, Women Business Owners, Click here to register.

Mar. 4, 3:00 p.m. ET, Asian-American + Pacific Islander, Native American + Tribal Small Business Owners; Click here to register.

Mar. 5, 1:00 p.m. ET, Black + African-American Small Business Owners, Click here to register.

Mar. 5, 3:00 p.m. ET, Hispanic Small Business Owners, Click here to register.

Mar. 6, 2:00 p.m. ET, Veterans, Self-Employed Business Owners, Click here to register.

Mar. 8, 3:00 p.m. ET, LGTBQ Business Owners, Youth Entrepreneurs, Restaurant Owners, Click here to register.

{ Comments on this entry are closed }

SBA PPP2 | SBA PPP2

Are you ready to begin the PPP forgiveness process?

Start by contacting your PPP lender and complete the correct form. Your Lender can provide you with either the SBA Form 3508, SBA Form 3508EZ, SBA Form 3508S, or a lender equivalent. The 3508EZ and the 3508S are shortened versions of the application for borrowers who meet specific requirements. Compile your documentation for your selected covered period. Include payroll records during covered period or the alternative payroll covered period, bank account statements that show cash compensation paid to employees, payroll tax forms, receipts, cancelled checks, or statements with employer contributions to employee health insurance and retirement plans. Non payroll items to include are business mortgage, rent, lease, utility payments. Once you have compiled all of your documentation, you are ready to submit the forgiveness form and attachments directly to your PPP lender. Stay in communication with your lender! SBA Loan Forgiveness

Happy New Year 2021! Stay safe and healthy! Lynnea Bylund

Email us with a request to schedule a call to discuss and we can provide further guidance.

#StayHome #StayStrong #SBA #PPP #EIDG #EIDL #CARESAct #PPP2 #NVGOED #PETSGRANT #Grateful #ClarkCountyNV #StabilizationGrant

{ Comments on this entry are closed }

NEW PPP bill passed in the House was just passed by the Senate!

Changes | New bill:

Increases the time frame to use PPP from 8 weeks to 24 weeks (optional).

Now requires at least 60% of the loan to be used on payroll to be forgiven.

Extends “safe harbor” date to hire back employees from June 30 to Dec 31.

{ Comments on this entry are closed }

In light of the developments regarding COVID-19, we would like to first say that our thoughts are with those affected by the virus in the United States and around the globe. As more jurisdictions across the country are closing schools, limiting large gatherings, and taking other measures to create social distance to minimize the spread of COVID-19, our team continues to work remotely. We have robust technology that enables our team to efficiently and effectively perform their work remotely.

Our founder has been working remotely since 1993, a first mover in remote bookkeeping services which inspired the founding of Catalyst QuickBooks Solutions in April 2008. In the mid-1990s our founder fought on Capitol Hill to redefine the Small Business Administration’s “SBA’ definition of small business as their guidelines excluded an important demographic that collectively represents as a super business power. We continue to monitor the developments of the SBA’s EIDG, EIDL, and PPP programs under the historic CARES Act 2020. Please email us to schedule a call. Stay safe and healthy! #StayHome #StayStrong #SBA #PPP #EIDG #EIDL #CARESAct

{ Comments on this entry are closed }

Gifts in kind, often called “in-kind donations,” are a type of charitable donation in which, rather than giving cash to a qualifying nonprofit NGO with which to purchase needed supplies and services, the goods and services are donated directly.

Gifts in kind, often called “in-kind donations,” are a type of charitable donation in which, rather than giving cash to a qualifying nonprofit NGO with which to purchase needed supplies and services, the goods and services are donated directly.

In-kind donations are distinguished from cash or stock shares gifts. While some nonprofit observers have debated the advantages of in-kind donations over giving cash, others have argued for the disadvantages of gifts in kind, particularly in the context of disaster relief. For a summary discussion, go to Wikipedia: Gifts in kind

Whatever the pros and cons, the annual volume of entering in-kind donations being made to nonprofits is on the rise.

So how does a nonprofit properly go about entering in-kind donations in QuickBooks?

{ Comments on this entry are closed }

As small business owners we all have different needs. The bookkeeping systems we select may vary, the specific reports that we access to make crucial business decisions may vary, even the frequency of our accounting may be vary. But at the foundation of it all is what we call a Chart Of Accounts. And your chart of accounts is specific to your business’ needs and, set up correctly, it often will be different from that of other companies.

So What is the Chart of Accounts?

So What is the Chart of Accounts?

Our business dictionary defines the chart of accounts as a “System of accounting records developed by an organization to be compatible with its particular financial structure, and in agreement with the amount of detail required in its financial statements.”

Click here to see a sample Chart of Accounts

{ Comments on this entry are closed }